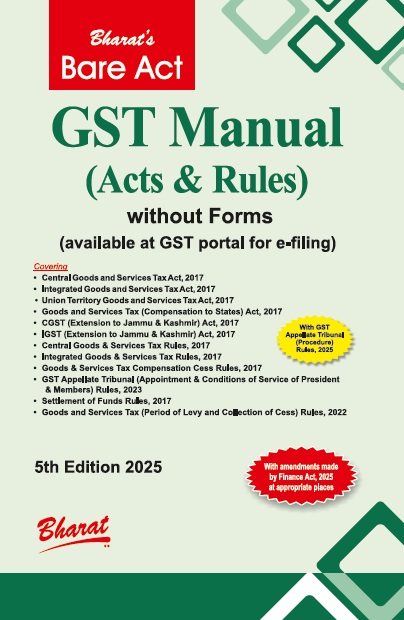

GST Manual (Acts & Rules) – Buy Online at Paresh & Company.

GST Manual Act & Rules

This comprehensive GST Manual includes all the updated Acts, Rules, and procedural guidelines relevant to taxation professionals, students, and business owners. It is especially beneficial for CA, CS, CMA aspirants, and corporate tax executives.

Covering the full framework of GST laws in India, including the latest updates till 2025, this book is a one-stop reference for understanding and applying GST regulations.

- Chapter 1 – Central Goods and Services Tax Act, 2017

- Chapter 2 – Integrated Goods and Services Tax Act, 2017

- Chapter 3 – Union Territory Goods and Services Tax Act, 2017

- Chapter 4 – GST (Compensation to States) Act, 2017

- Chapter 5 – CGST (Extension to Jammu and Kashmir) Act, 2017

- Chapter 6 – IGST (Extension to Jammu and Kashmir) Act, 2017

- Chapter 7 – Central GST Rules, 2017

- Chapter 8 – Integrated GST Rules, 2017

- Chapter 9 – GST Compensation Cess Rules, 2017

- Chapter 10 – GST Appellate Tribunal Rules, 2023

- Chapter 11 – GST Settlement of Funds Rules, 2017

- Chapter 12 – GST (Period of Levy and Collection of Cess) Rules, 2022

- Chapter 13 – GST Appellate Tribunal (Procedure) Rules, 2025

With this book, stay updated on all legislative changes and stay compliant with India’s dynamic tax framework.